AI Accounting Agent

An AI Accounting Agent is an intelligent virtual assistant designed to automate and optimize accounting processes for businesses. Leveraging artificial intelligence, machine learning, and data analytics, it can handle tasks such as bookkeeping, expense tracking, invoice management, account reconciliation, financial reporting, and tax compliance — all with minimal human intervention.The AI Accounting Agent integrates seamlessly with accounting software, ERP systems, and banking platforms, enabling real-time data processing, automatic record updates, and accurate financial tracking. It can also assist employees or clients by answering queries related to transactions, invoices, or account balances, providing fast and reliable support.

How AI Accounting Agents Improve Accuracy and Reduce Workload

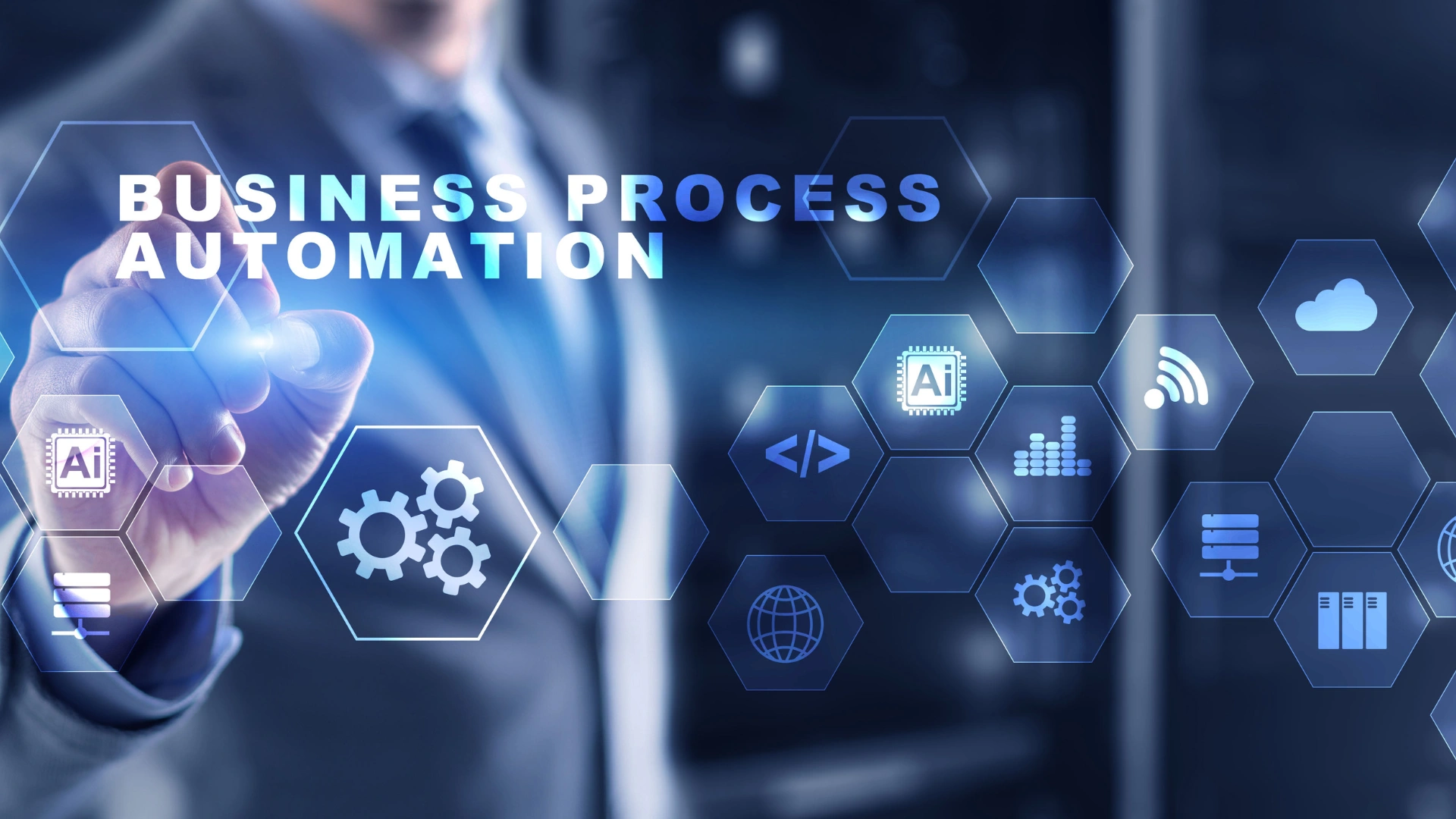

AI Accounting Agents are transforming the accounting landscape by automating routine and time-consuming tasks while ensuring precision and reliability. Leveraging artificial intelligence, machine learning, and data analytics, these agents can handle bookkeeping, invoice processing, account reconciliation, expense tracking, and financial reporting with minimal human intervention.By automating repetitive accounting processes, AI Accounting Agents significantly reduce the risk of human errors, ensure compliance with regulations, and maintain accurate financial records. They integrate seamlessly with accounting software, ERP systems, and banking platforms, allowing real-time updates and smooth data flow across financial operations.

Our Approach to AI Accounting Agent Solutions

At the core of our AI Accounting Agent solutions is a focus on automating and optimizing accounting workflows to increase efficiency, accuracy, and reliability. We design intelligent agents that leverage artificial intelligence, machine learning, and data analytics to handle tasks such as bookkeeping, invoice processing, account reconciliation, expense tracking, and financial reporting.

Intelligent Automation of Accounting Tasks

We design AI Accounting Agents to automate repetitive accounting processes such as bookkeeping, invoice processing, and account reconciliation, reducing manual effort.

Seamless System Integration

Our agents integrate with existing accounting software, ERP systems, and banking platforms, ensuring real-time data updates and smooth workflow across all financial operations.

Real-Time Financial Insights

The AI Accounting Agent analyzes financial data continuously, providing actionable insights to support informed decision-making and strategic financial planning.

Enhanced Accuracy and Compliance

By leveraging AI and machine learning, the agent ensures precise financial records, accurate reporting, and adherence to regulatory compliance standards.

24/7 Availability and Support

Operating around the clock, the AI Accounting Agent handles queries related to transactions, invoices, and account balances, providing instant assistance to employees and clients.

Scalability and Efficiency

Our solutions are scalable to accommodate business growth, enabling efficient management of increasing financial transactions while allowing finance teams to focus.

AI Accounting Agent – Smarter, Faster, and More Accurate Accounting

The AI Accounting Agent is a powerful digital assistant designed to transform traditional accounting processes into smarter, faster, and more accurate operations. Leveraging artificial intelligence, machine learning, and advanced data analytics, it automates repetitive accounting tasks such as bookkeeping, invoice processing, account reconciliation, expense tracking, and financial reporting.By minimizing human errors and ensuring compliance with financial regulations, the AI Accounting Agent enhances accuracy while saving time and operational costs. It seamlessly integrates with accounting software, ERP systems, and banking platforms to maintain real-time updates and ensure smooth workflows.

Next-Generation Automation for Accurate Accounting

Next-generation AI Accounting Agents are transforming accounting operations by automating repetitive and time-consuming tasks while ensuring precision and compliance. Using artificial intelligence, machine learning, and data analytics, these agents handle tasks such as invoice processing, expense tracking, bookkeeping, account reconciliation, and financial reporting with minimal human intervention.

By integrating seamlessly with accounting software, ERP systems, and banking platforms, AI Accounting Agents provide real-time updates, maintain error-free records, and streamline workflows across the organization. They also offer instant support by answering queries related to transactions, invoices, budgets, or account balances, enhancing responsiveness for employees and clients alike.

FAQ

What is an AI Accounting Agent?

An AI Accounting Agent is an intelligent virtual assistant that automates accounting tasks such as bookkeeping, invoice processing, expense tracking, account reconciliation, and financial reporting.

How does an AI Accounting Agent improve accuracy?

It reduces human error by automating repetitive tasks, ensuring precise financial records, and maintaining compliance with accounting standards.

Can it integrate with existing accounting systems?

Yes. AI Accounting Agents seamlessly integrate with accounting software, ERP systems, and banking platforms to maintain real-time updates and streamline workflows.

Does it provide real-time financial insights?

Absolutely. It analyzes financial data continuously, providing actionable insights for smarter decision-making and better financial planning.

Can it assist employees and clients directly?

Yes. AI Accounting Agents can answer queries about invoices, account balances, transactions, and budgets instantly, improving responsiveness and support.

Does it operate 24/7?

Yes. It works around the clock, ensuring continuous support, faster processing, and consistent management of accounting operations.

What are the main benefits of using an AI Accounting Agent?

Key benefits include improved accuracy, reduced workload, enhanced efficiency, cost savings, compliance assurance, real-time insights, and the ability to focus on strategic financial tasks.